I am on a personal mission for you to use the app’s frozen feature. As CEO of Warchest, I use Warchest to run the company’s budget so I can both manage an accurate budget and to better participate in product development conversations when we’re considering potential upgrades and new features. In this latter process I recently learned I personally account for the majority of budgets being frozen. Considering we have hundreds of campaigns with thousands of users budgeting on Warchest, and given how useful I find this feature, this surprised and horrified me, and it must change!

Use this!

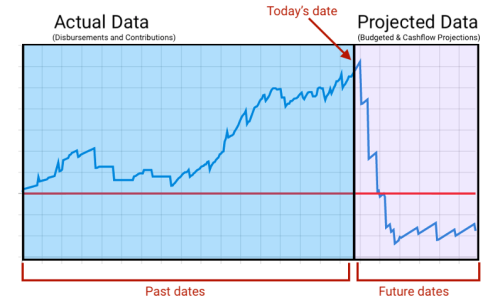

A quick refresher on how time works in Warchest is helpful. The numbers on your Warchest Dashboard assume your actuals more accurately reflect what has happened to your budget in the past than what you projected. If you budgeted to spend $100 yesterday on coffee but you actually spent $50, $50 is more precise than $100 (though you should reconcile the budgeted value to $50, more on that later).

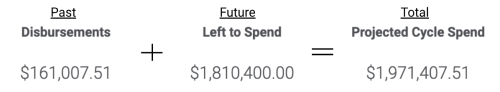

So the Projected Cycle Spend, for example, is not everything you budgeted to spend for the cycle, but a hybrid of the past and future – what you plan to spend from today to the end of the cycle plus what you have spent from yesterday to the beginning of the cycle (whether today’s projections or actuals are considered depends on the “Today’s Data” toggle on the top right).

This means time is moving through your Warchest day by day, shifting from relying on your projections to relying on your actuals.

This means time is moving through your Warchest day by day, shifting from relying on your projections to relying on your actuals.

This is why reconciling is so important. If you budgeted to spend $100 on coffee yesterday but that didn’t happen and is instead going to happen tomorrow, that $100 is not accounted for in your Disbursements or Left to Spend unless you reconcile and move that $100 budgeted amount to tomorrow. This is the only way to ensure your budget is accurate.

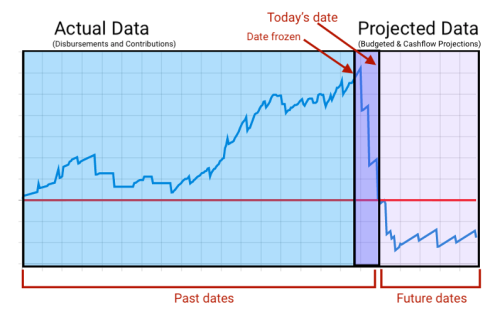

This is where freezing comes in. Freezing a budget pauses time in that budget so projections and actuals are not shifting day by day. Instead, the budget will reflect actuals from before that date and projections after that date and will not update until the budget is unfrozen. A budgeted amount for $100 tomorrow will always be counted, until unfrozen, because it will always be considered a projected amount.

When is freezing helpful? Glad you asked! Freezing can be helpful in many instances, including (but not limited to):

- If you are planning to present your budget three days from now but you can only reconcile your budget today. You can freeze your budget after reconciliation and present your fully reconciled budget as of that date feeling confident all budgeted amounts are reflected.

- When you first set up your budget, you may want to freeze your full campaign to refer back to your initial projections.

- When you switch from one budget scenario to another (ie., Shoestring to Cadillac) it can be helpful to freeze the previous scenario in time, to retain what your budget looked like before switching scenarios.

- If you are checking your budget more often than you are updating your actuals and projections, it can also be helpful to freeze your campaign until you are ready to reconcile your budget.

I routinely freeze the company’s budget after each time I reconcile so I can make reports from that budget until I reconcile it again. I also duplicate the company’s reconciled budget at the end of each quarter and freeze that copy so I can refer to it later in the year.

Freezing is easy, and there are two places in the app you can freeze a budget:

- On the dashboard

- In Manage Campaigns. Freezing here permits selecting any date to make your frozen as of date.

Warchest, as an app and a company, are strong advocates of frequently reconciling. That is the best way to guarantee an accurate budget, so don’t freeze your budget for too long, otherwise the information will become stale. But freezing your budget allows you to temporarily take a break from reconciling to permit robust analysis and collaboration on your budget. So I hope you will join me and add this tool to your budgeting practice!